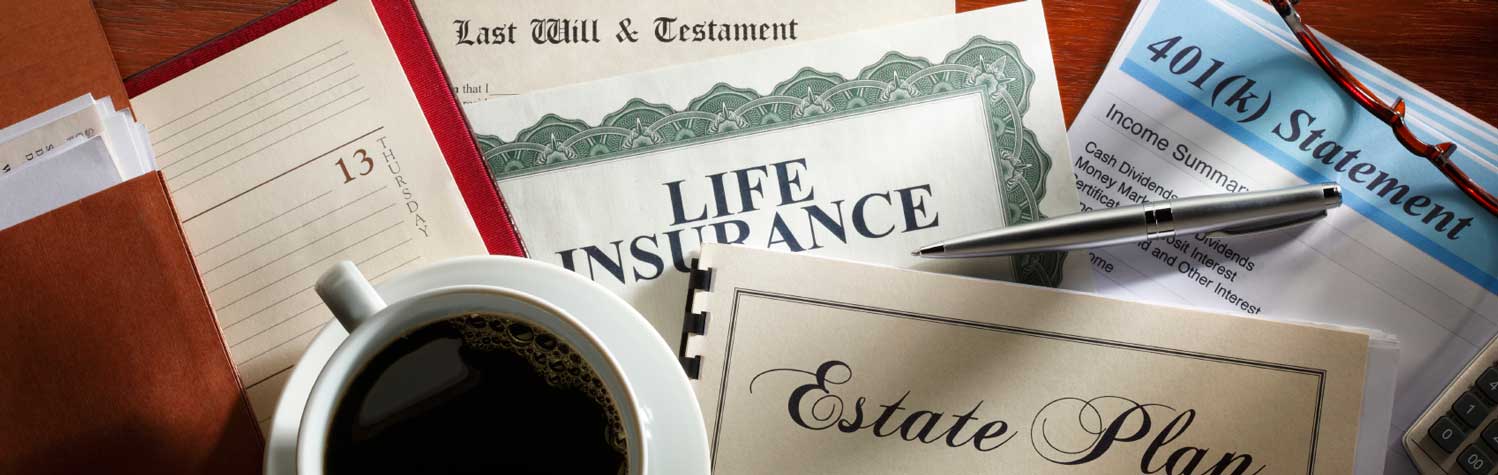

We help our clients protect their financial and non-financial wealth

Protecting clients and their families is what we do. Combined, our Little Rock based attorneys have over 90 years of experience helping our clients protect what they have built and saved for themselves–and for generations to come. For almost every client, that means:

CLICK HERE TO LEARN MORE

- Protecting what you have for yourself during your lifetime, including:

-Protection from potential legal judgments

-The management of your property if you become incapacitated by persons you choose without a court supervised guardianship.

-Insuring that your health care decisions are made by the persons you choose. - Protecting what you have from the cost of nursing home care

- Passing what you have to the people and charities you care about when you are gone

- Protecting the inheritance you leave your spouse and your heirs from divorce, lawsuits and lack of financial skill or youthful immaturity

- Reducing the inconvenience, cost and expense of the transition

What Risks Worry You?

Each estate plan we create is designed to protect our client from the risks that threaten them. Those risks are not the same for each client family. We have developed a risk analysis tool to help you assess the risks that matter to you.

CLICK HERE TO LEARN MORE

The most common risks our clients identify are:

- The expense, delay and publicity of a court supervised guardianship or probate proceeding

- The cost of nursing home care

- The loss of an inheritance by an heir because of a divorce, a legal judgment or financial immaturity

- The care and education of a minor or disabled child

- The loss of assets upon the remarriage of a surviving spouse after the first spouse dies

We Have Solutions.

There are powerful and effective solutions that can reduce or eliminate each of the risks that keep you awake at night. There are more than fifty legal tools and strategies in our solutions arsenal. This is just a partial list of the solutions we commonly use to help clients protect get the protection they want:

CLICK HERE TO LEARN MORE

- Living Trusts

- Durable Powers of Attorney

- Health Care Powers of Attorney

- Medicaid Asset Protection Trusts

- Veterans Asset Protection Trusts

- Irrevocable Life Insurance Trusts

- Domestic Asset Protection Trusts

- Third Party Asset Protection Trusts

- Offshore Trusts

- Alaska & Tennessee Community Property Trusts

- Limited Partnerships and Limited Liability Companies

- Charitable Remainder Trusts

- Sales to Grantor Trusts

- Self-Cancelling Installment Notes

- Private Annuities

- Family Foundations and Donor Advised Funds

After we get to know you and come to understand the risks that are a specific concern for you, our skilled attorneys–using some combination of those solutions–can help you put a plan in place that will give you the protection and peace of mind you want. Because every client is unique, every plan is unique. Our Three Step Process is specifically designed to uncover authentic concerns and then address them with solutions that will work for every client.

We are Serious About Our Mission

We read our mission statement every week at our Friday morning staff meeting. This way, we remind ourselves why we are here and why we do what we do. There are three very specific commitments we make to each of our clients:

We have developed a unique Three Step Process we follow with each client that delivers on our mission.

Why I Did Not Want to Be An Estate Planner

Our partner Stan Miller talks about how he was completely turned off by estate planning when he was at Vanderbilt Law School and only later discovered that estate planning was much more about people caring for each other than families fighting with each other.

Our Three Step Planning Process

In this video, Little Rock estate planning attorney Stan Miller explains our firm’s unique Three Step Planning Process. He describes how this process is used to identify the risks that are specific concerns for clients and how the firm’s estate planning attorneys choose from a range of over 50 planning tools and options to produce a result for clients that is both compelling and understandable.

ILP + The Book

It is possible to protect yourself, your family and your business or professional practice from the real threats that keep you up at night. The law provides more and better solutions than ever before in history. In this book, Stan explains in clear, understandable language how these powerful solutions can be deployed to protect what you have earned and built.

Available Early Summer 2015

ILP + The Webinar

In this hour-long webinar, Stan explains how to avoid probate and protect your heirs with a revocable living trust. You will learn how to protect your loved ones what many consider to be an expensive, lengthy, and unnecessary court process. You will also learn what a living trust is and why having a living trust will protect your children, grandchildren and other heirs.

Available Now