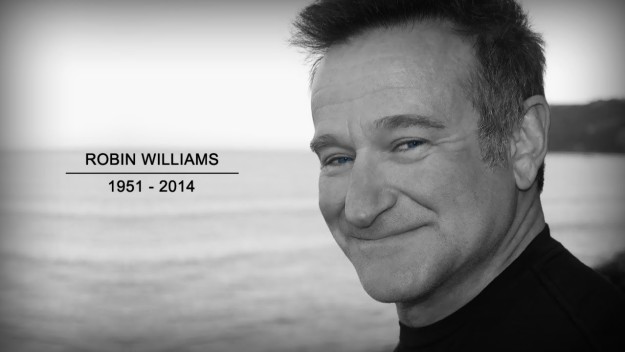

What Happened to Robin Williams’ Estate?

Millions of fans mourned the 2014 death of actor Robin Williams – no one more so, perhaps, than his wife and his three children. Just a few months after his passing, however, the family he left behind became locked in a new and heated struggle: a dispute over how to interpret specific instructions in the actor’s estate plan.